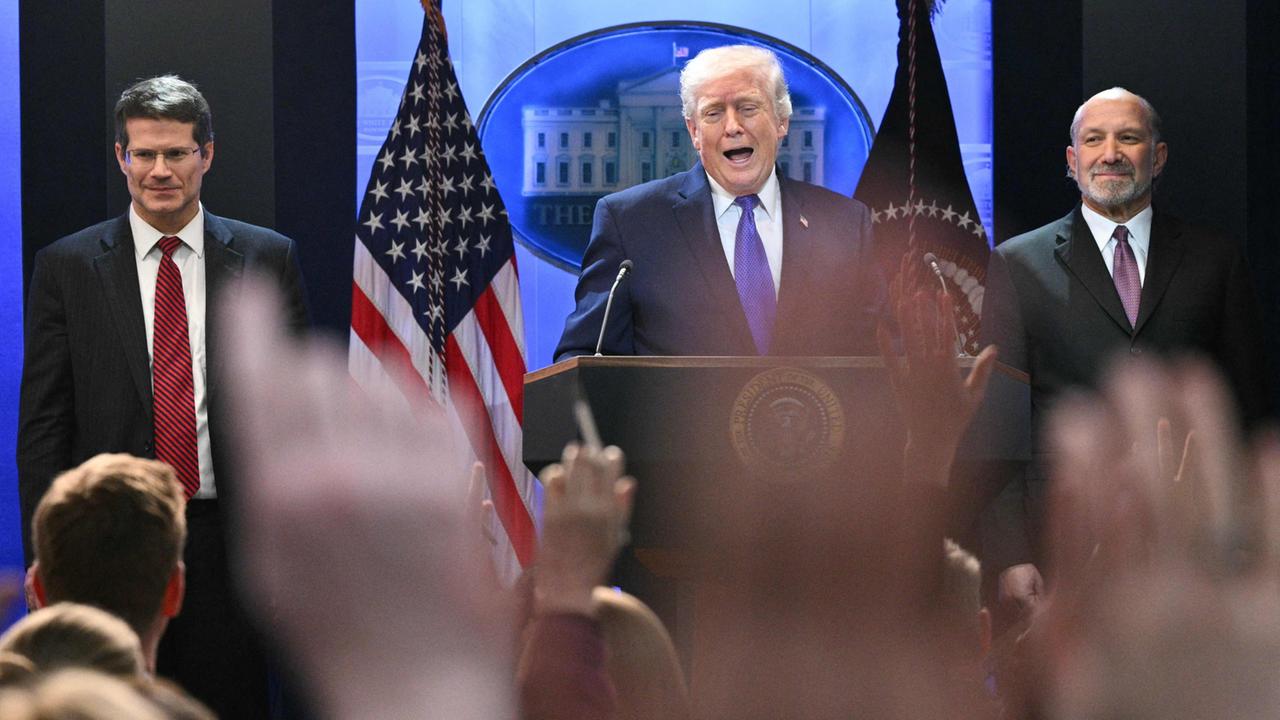

Every weekday, the CNBC Investing Club with Jim Cramer releases the Homestretch — an actionable afternoon update, just in time for the last hour of trading on Wall Street. The S & P 500 moved higher Friday in what’s been a volatile session. The news of the day was the Supreme Court striking down President Donald Trump ‘s emergency tariffs in a 6-3 decision. Trump responded in the afternoon by saying he will impose 10% global tariffs under Section 122. Those new levies can only last for 150 days without further congressional action to extend. Trump pointed out the Supreme Court’s decision does not impact Section 232 and 301 tariffs. The president also expressed frustration that Friday’s ruling did not deal with whether tariff revenue already collected will have to be refunded or not. Trump suggested that further litigation may be needed to resolve that matter. NKE 1D mountain Nike 1 day When the high court news first broke around 10 a.m. ET, there were strong bursts in stocks of companies whose profits have been hit by tariffs. For example, Nike was one of the stocks in the portfolio that’s been the most negatively impacted by tariffs. The company has baked in a $1.5 billion cost headwind this fiscal year from tariffs. As expected, shares of the shoe and athletic apparel maker briefly traded higher to above $68 immediately after the decision. But the market quickly realized that Trump would find other methods to put levies on imports or restrict trade. He did just that, explaining why Nike reversed and gave back all its gains. Cybersecurity stocks , including CrowdStrike and Palo Alto Networks , dropped after Anthropic announced Friday the availability of Claude Code Security. The AI research company said this new tool can scan codebases for security vulnerabilities and suggest software patches for human review. As shareholders in CrowdStrike and Palo Alto Networks and firm believers that AI and the proliferation of digital agents will increase the need for cybersecurity vendors, the reaction to the press release is another unfortunate example of how sensitive stocks are to announcements when the market believes they are in the AI disruption crosshairs. Club earnings ramp up next week , with Home Depot , TJX , Salesforce , Nvidia , and Qnity all reporting their quarter results. Nvidia is the big one that the market is waiting for. We booked some profits in our Qnity position Friday as shares of the DuPont spin-off has recently soared. Next week also brings key economic reports, including durable goods, consumer confidence, jobless claims, and the producer price index. (See here for a full list of the stocks in Jim Cramer’s Charitable Trust.) As a subscriber to the CNBC Investing Club with Jim Cramer, you will receive a trade alert before Jim makes a trade. Jim waits 45 minutes after sending a trade alert before buying or selling a stock in his charitable trust’s portfolio. If Jim has talked about a stock on CNBC TV, he waits 72 hours after issuing the trade alert before executing the trade. THE ABOVE INVESTING CLUB INFORMATION IS SUBJECT TO OUR TERMS AND CONDITIONS AND PRIVACY POLICY , TOGETHER WITH OUR DISCLAIMER . NO FIDUCIARY OBLIGATION OR DUTY EXISTS, OR IS CREATED, BY VIRTUE OF YOUR RECEIPT OF ANY INFORMATION PROVIDED IN CONNECTION WITH THE INVESTING CLUB. NO SPECIFIC OUTCOME OR PROFIT IS GUARANTEED.

Nike swings exemplify the market’s uncertainty about Trump tariffs ruling